Sunday, June 20, 2021

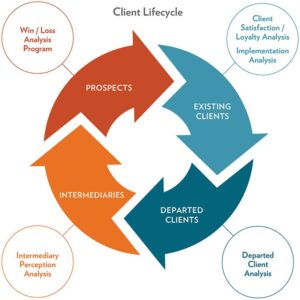

In previous posts we looked at how win / loss is a tool for getting 360° feedback in terms of commentary on all parts of an organization. Win / loss can also lead to a different kind of holistic feedback: research that touches all parts of a client lifecycle.

In previous posts we looked at how win / loss is a tool for getting 360° feedback in terms of commentary on all parts of an organization. Win / loss can also lead to a different kind of holistic feedback: research that touches all parts of a client lifecycle.

Below are examples of how companies can increase the value of their research by adding an additional feedback type, or a third leg of the stool, to their win / loss program:

Post Implementation

Win / loss works best in high-dollar value sales situations. When a company brings on a high revenue client, that new customer represents an even higher potential Customer Lifetime Value (CLV). The projected revenue of a new customer is not a straight-line calculation either. Each new client represents cross-sell, up-sell, and referral opportunities as well. Given the potential revenue that each new client represents, it is critically important to make sure each relationship starts off on the right foot.

Unfortunately, Anova’s research has indicated that about one-third (36%) of new clients cite post-sales issues as a pain point in win interviews. However, within the win interview the respondent is covering so many other different topics (e.g. sales performance, impressions of the solution, competitive rankings) that the post-sales feedback may not be as detailed as companies need to truly understand the client’s onboarding experience.

That is why many Anova clients institute a post implementation program that runs in congruence with the win / loss program. The PI program captures feedback specifically on the implementation process, giving companies richer detail about client pain points and allowing them to take well-informed corrective steps to improve their onboarding processes.

By ensuring that new clients have a seamless onboarding experience, companies set themselves up for unlocking substantial future revenue.

Client Satisfaction

Similar to ensuring the implementation process goes well, it is critical for companies to deeply understand the health of their existing client base. Though many companies rely on web surveys to keep tabs on their client satisfaction, for complex client situations it is imperative to go beyond NPS ratings and into actionable, detailed feedback in order to ensure clients’ needs are being met.

An example of this is illuminated by one of Anova’s clients which is in the corporate travel space. Many of the situations submitted for the company’s win / loss program are rebid opportunities. During aggregate reports, Anova often segments the results by rebid vs. new business situations. In past years, Anova pinpointed that in those unsuccessful rebids, clients were lamenting that the company did not address ongoing service concerns in the renewal discussions. The company knew it had to improve the level of knowledge their account teams had about the ongoing relationships before the renewal discussions so the team could work to address the issues either in practice or with a plan moving forward.

By implementing a client satisfaction program to collect feedback about the relationship before the client’s decision, and then react to the feedback accordingly, the client was able to achieve their highest retention rate in recent years.

Churn

Another common use case for incorporating a third type of research into win / loss programs is through churn interviews. Similar to loss debriefs, an interview with a departed client puts the spotlight on why customers did not choose to continue a relationship with a company. Additionally, the interviews provide unparalleled competitive intelligence by capturing feedback as to why a rival firm was selected instead.

By doing churn interviews along with win / loss, companies can better understand how consistent their client experience is from the perceived (feedback from new business prospects before they begin working with the company) to the actual (feedback after a relationship existed and ended). If, for example, missing functionality on a platform is a key reason why a company is both losing new business and experiencing churn, that clearly highlights a competitive gap in their solution. If a key feature of the platform is being cited as a strength in win interviews but subsequently shows up as a churn driver, that indicates a lack of consistent experience around that tool, either because of unrealistic expectation setting from the sales team or insufficient follow-through on the CX side.

Intermediary Perception

The last, but certainly not least, piece to the client lifecycle is intermediaries. Whether it is in the form of a search consultant, advisor, channel partner, or VARS, third parties are common in sophisticated B2B marketplaces.

Because of the influence these intermediaries have, gathering their feedback can unlock potential holes in the win / loss feedback loop. For example, in the defined contribution space interviewing plan sponsors provides some feedback, but it is an advisor who often controls the playing field and evaluation criteria. Interviewing advisors can provide more meaningful details to supplement a data set. Additionally, these advisors have a broader, more advanced understanding of the marketplace from their work with different providers and on other searches. By adding advisor perception interviews to the win / loss program, one Anova client was able to gain a more holistic understanding of how their firm was being perceived and was able to increase its win rate over 15%.

**

More and more companies are graduating from asking “why should we do win / loss?” to “how do we make our win / loss program best in class?”. Rounding out the feedback loop with additional perspectives from the customer’s lifecycle is a highly impactful way of taking research programs to the next level.