Thursday, January 23, 2025

“How did we lose that deal?!” or “Why did our competitor win over us?” These are common questions sales leaders ask their teams, and they are fair questions—business leaders need honest answers to win the next deal.

When a salesperson asks a decision-maker why they won or lost a deal, the truth is often disguised or not shared at all. In fact, salespeople only know the exact reasons behind a decision 40% of the time. At Anova, we work to close this gap by conducting Win-Loss interviews as a neutral third-party. One of the key questions we ask is, “What were the top three reasons for your decision to choose the winning provider?”

By aggregating this feedback, a story emerges. Our analysis helps clients understand what they did well when they won and where competitors outperformed them in losses. This raised a key question for us: What do these stories tell us about the attributes that drive buying decisions?

Mature vs. Growth Markets

To answer this, we grouped companies into two categories:

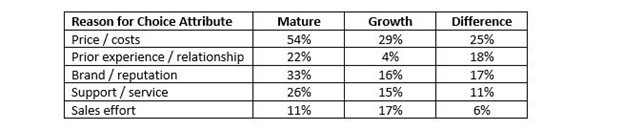

When analyzing aggregate data, key trends emerged. The top five decision-making attributes with the greatest differences between these market types were:

The percentage of time each of those attributes were mentioned as a reason for choosing a provider can be seen in the table below:

This data reveals that there are real differences between the two industry types. If one were to rank the attributes in each market separately, price, brand and service are the three most important decision criteria in Mature industries, but price, sales, and brand have the most influence over decisions in Growth markets.

In summary:

Price is the most frequently mentioned attribute in each market and also has the widest disparity in mentions, signaling a difference in how influential costs can be.