Tuesday, May 5, 2015

by Sarah Simoneaux, CPC

DST Retirement Solutions offers a broad array of retirement plan servicing options for financial organizations distributing retirement investment products and serving their customers’ retirement needs. For almost two decades, DST Retirement Solutions clients—mutual funds, banks, insurance companies and third party administrators—have benefited from the firm’s experience, innovation and commitment to continually invest in technology and deliver excellence in outsourcing services.

DST Retirement Solutions’ commitment to excellence prompted a training initiative and relationship with ASPPA that began in 2008, with the formal adoption of ASPPA’s Retirement Plan Fundamentals (RPF) program in September of 2008. When asked about the reasons behind the training initiative, Jane Brennan, division vice president and COO, DST Retirement Solutions, explained, “Regardless of economic climate, we are committed to investing in the development of our associates and providing superior service on behalf of our clients. We wanted to raise the bar and provide even more knowledgeable, timely, flexible and responsive service to our clients.” After researching several alternatives, DST Retirement Solutions ultimately chose ASPPA’s RPF program, and Jane highlighted the main reasons for the choice. “We liked that ASPPA offers an online, self-study program in addition to an exam, which allows us to benchmark our success. We also believe that ASPPA’s Retirement Plan Fundamentals Certificate program is a solid, reputable certificate program that carries a lot of weight in our industry.”

During 2008 and 2009, DST Retirement Solutions put approximately 120 employees through the RPF program. Upon successful completion of the RPF-1 and RPF-2 exams, these employees were awarded the ASPPA Retirement Plan Fundamentals Certificate. For 2010, DST Retirement Solutions has targeted a group of 25 additional employees to complete the RPF program, primarily consisting of new employees who have not yet gone through the training. This year, the firm will also utilize ASPPA’s online RPF web courses (produced by Indiana University-Purdue University Fort Wayne) in a classroom setting to assist with training.

A Successful Phased Approach

DST Retirement Solutions approached the training initiative in phases, first targeting “client-facing” employees and then extending the initiative to all remaining employees “who touch a plan.” Phase 1 training included approximately 75 DST Retirement Solutions associates. These associates held retirement plan account manager (RPAM) positions. The RPAMs interact directly with plan sponsors, TPAs and advisors, and they manage the plan sponsor relationships day-to-day. Phase 1 also included the DST Retirement Solutions compliance team. These employees are responsible for nondiscrimination testing, document design and 5500 reporting. The first group started in September 2008 and completed the training and exams by early December 2008 (approximately three months).

Phase 2 was comprised of 45 associates, including new associates fulfilling either of the above-described roles (RPAMs or compliance staff), as well as plan conversion specialists and all client relationship representatives. This second group began preparing in April 2009 and completed the RPF-1 and RPF-2 courses and exams by July 2009.

The Learning Experience

To maximize effectiveness of the training initiative, DST Retirement Solutions utilized ASPPA’s Retirement Plan Fundamentals self-study program materials (online study materials, RPF study guides and practice exams) and supplemented with custom classroom training that the firm developed internally. They held working lunch sessions where topics from chapters of the ASPPA RPF study guides were reviewed and explored in detail. DST Retirement Solutions developed an assessment tool to determine where associates might need additional education to prepare for the exam. They analyzed the results of these assessments by person and by group, and identified key areas where associates needed additional study for the exam.

Editor’s Note: In 2009, ASPPA made available automated pre-assessments to assist firms with this type of individual assessment and candidate feedback prior to taking the exams.

In addition to the firm’s organized efforts, some associates formed additional study groups independently, meeting weekly to discuss what they’d read in the online materials. The overall initiative proved to be a very motivating experience for the firm’s employees.

The Catalyst for the DST Retirement

Solutions Training Initiative

The firm’s commitment to excellence was the catalyst. DST Retirement Solutions recognizes how critical the RPAM role is. As Jane points out, “We know that having a strategic relationship with the plan manager is a top requirement of plan sponsors and correlates highly with satisfaction. We also know that a lot of our larger institutional clients participate with the Anova Consulting Group in conducting surveys that gauge plan sponsors’ relationships with plan managers.”

DST Retirement Solutions’ internal learning and development organization enhanced the internal training curriculum for new associates, but the firm wanted to provide added advanced training for the RPAMs and compliance teams. After careful consideration of several different organizations for this advanced training expertise, the decision was made to utilize ASPPA’s education programs.

DST Retirement Solutions now requires that all RPAMs and compliance associates attain the ASPPA Retirement Plan Fundamentals Certificate within their first year on the job.

Positioned for the Future

When asked if the training initiative has yielded positive benefits, Jane responds enthusiastically. “Our RPAMs are now positioned to play a much more proactive, consultative role with the plan sponsors with whom they interface. We have implemented several internal changes with regard to the RPAM role, and certainly training and education played a big part in these efforts.” Jane also points out that DST Retirement Solutions has seen the Anova survey scores go up significantly, as well as the scores in the annual customer surveys with their institutional clients.

“The ASPPA training we undertook represents one of the most far-reaching and strategic training and education that we’ve done,” says Jane. “Although it was a big endeavor, our associates were eager to get going on this and have the ASPPA certification under their belts. They thanked us for that opportunity—for our willingness to invest in their future. Three members of our management team are already affiliated or credentialed ASPPA members.”

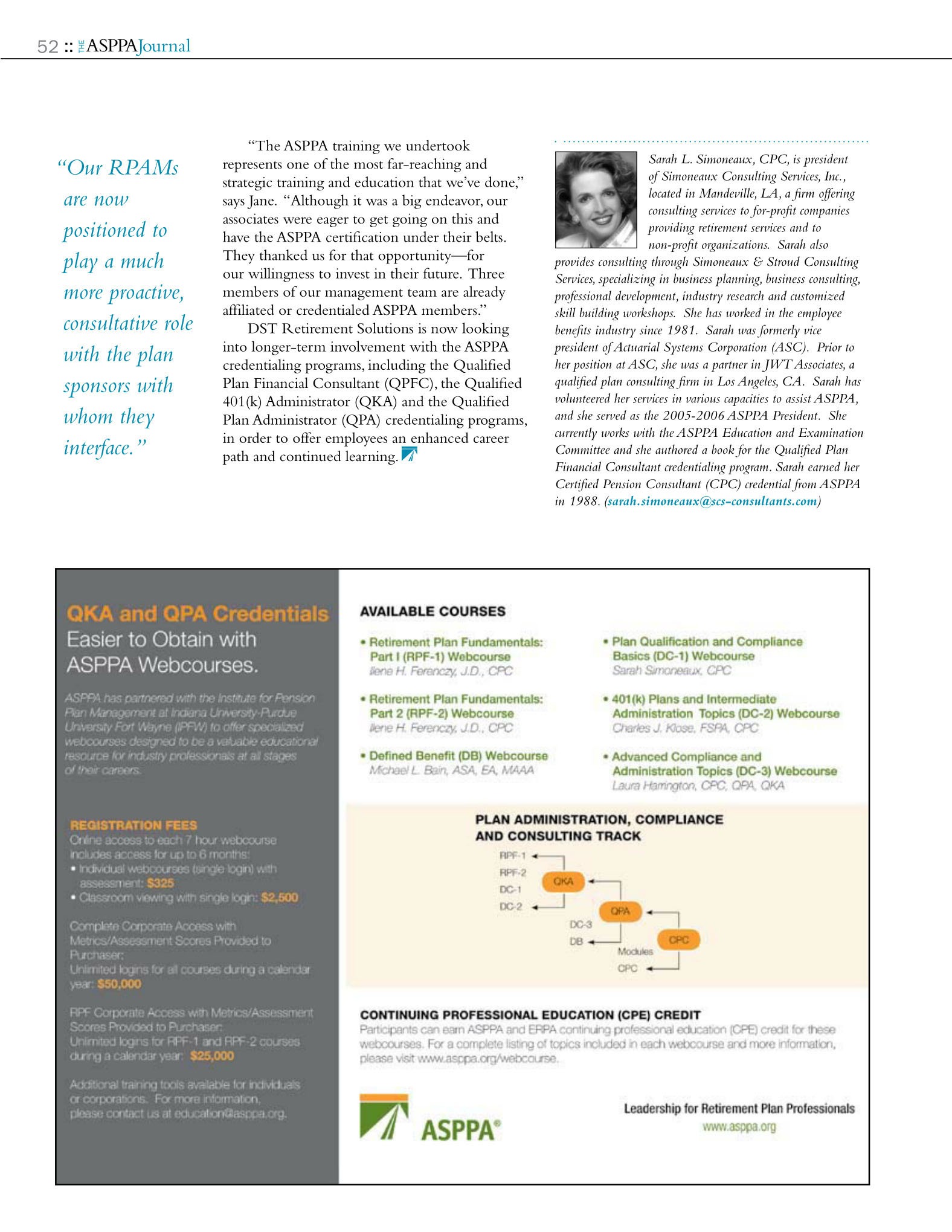

DST Retirement Solutions is now looking into longer-term involvement with the ASPPA credentialing programs, including the Qualified Plan Financial Consultant (QPFC), the Qualified 401(k) Administrator (QKA) and the Qualified Plan Administrator (QPA) credentialing programs, in order to offer employees an enhanced career path and continued learning.

Sarah L. Simoneaux, CPC, is president of Simoneaux Consulting Services, Inc., located in Mandeville, LA, a firm offering consulting services to for-profit companies providing retirement services and to non-profit organizations. Sarah also provides consulting through Simoneaux & Stroud Consulting Services, specializing in business planning, business consulting, professional development, industry research and customized skill building workshops. She has worked in the employee benefits industry since 1981. Sarah was formerly vice president of Actuarial Systems Corporation (ASC). Prior to her position at ASC, she was a partner in JWT Associates, a qualified plan consulting firm in Los Angeles, CA. Sarah has volunteered her services in various capacities to assist ASPPA, and she served as the 2005-2006 ASPPA President. She currently works with the ASPPA Education and Examination Committee and she authored a book for the Qualified Plan Financial Consultant credentialing program. Sarah earned her Certified Pension Consultant (CPC) credential from ASPPA in 1988.