Where would a market research company like Anova be without its people? What possible insights and strategies could such a consulting firm offer to its clients without the bedrock of data, stats, and open-ended feedback? The truth is: nowhere.

Where would a market research company like Anova be without its people? What possible insights and strategies could such a consulting firm offer to its clients without the bedrock of data, stats, and open-ended feedback? The truth is: nowhere.

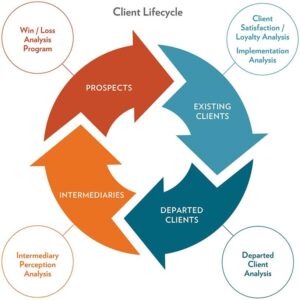

Whether it be a win / loss program, a departed client program, or client satisfaction program, a key element to Anova’s success it is Executive Interviewer team. In fact, it is probably Anova’s main differentiator in the competitive marketplace. Anova’s interviewers know what they are doing, and they do it better than most.

This is an invitation from our team to yours. Get to know what the Executive Interviewer experience means to you – whether you are our prospect, our client, or just someone on a quest to learn more about Anova – through an interview with one of Anova’s Executive Interviewers, Jeannine Kulsick.

Anova: First, you’ve been with Anova as an Executive Interviewer for seven years. How did you get into this role?

Jeannine: I was introduced to win / loss research while at my previous company and was the consumer of the research. It made such an impact on our business and culture, and ten years ago the idea of win / loss was not entirely mainstream. It was like a little a secret advantage we had over our competitors. I was so intrigued by the work, I made a move from consuming the research to leading the research.

Anova: What skills come into play as an Executive Interviewer?

Jeannine: At Anova, this isn’t about calling someone a thousand times and trying to get through the questions as quickly as possible. There is a certain art to it. To be successful in this role for our clients, I must be a few different things at the same time: accessible and easy to get along with, understanding of people’s time and perspectives, knowledgeable about the industry I am researching within, and competitive with myself to get a great result. I also must be curious. At Anova, this is not about a flat Q&A format. We have to ask beyond the initial question to get to the really good stuff. Getting there is all about curiosity.

Anova: It sounds like probing is a big part of the success. Tell me more about that part.

Jeannine: Yes, that’s the challenging part. We have an interview guide that is negotiated with our client and as part of the program’s kick off, there is a lot of knowledge transfer and training around the program’s goals. Once engaged with an interviewee, as an Executive Interviewer, I am always looking for that next level – the details, the specifics, and the story. I may ask one question that leads to four or five more. It is my job to drill down on the critical aspects of what was important to our client, but also what was important to the prospect. When I get this kind of feedback for our clients, I know it’s a job well done.

Anova: What do you learn from your teammates? The other Executive Interviewers?

Jeannine: So much. We have all walked the walk and talked the talk, just from different perspectives. My colleagues come from the spaces and markets Anova partners with, and bring anywhere from 10 to 30+ years of experience. There’s a lot of knowledge in-house on our team and we are always sharing with each other. It helps deliver better research, really. We’ve done the presenting, we’ve serviced clients, we’ve had to explain why an important client left for a competitor, we’ve journeyed through our own long sales cycles. I think having these perspectives encourage us to think about what we can do to help our clients learn about what they are doing (or not doing!).

***

We extend an offer to continue this conversation. In our next From Our Team to Yours blog, get to know lessons and perspectives from one of Anova’s Analysts.

Practice? You can probably think of dozens of reasons why not to practice.

Practice? You can probably think of dozens of reasons why not to practice.

It takes too much time.

Practice is boring and is a drain.

You don’t need it. You’ve been selling to prospects and clients forever…

Even as kids growing up, practice seemed like a pain. After all, did any of us want to practice the piano or multiplication tables? As we mature to adults, the reasons to not practice evolve from reasons to excuses, and from excuses to barriers to success.

Practice matters. It makes us better. Just listen to a couple of world renowned athletes like Pele and Michael Jordan.

Pele, widely regarded as the greatest soccer player of all time, said, “Everything is practice.” Michael Jordan, credited with being one of the best basketball players ever and was one of the most effectively marketed athletes of his generation said, “You can practice shooting eight hours a day, but if your technique is wrong, then all you become is very good at shooting the wrong way. Get the fundamentals down and the level of everything you do will rise.”

But what does this have to do with Win / Loss research?

Anova’s team views itself as athletes. We are dedicated to training each of our client’s sales muscles so ultimately their level of competition rises. If you understand why you are winning or losing, you can find out where you need to practice.

Inevitably, feedback from prospects will include commentary about your salesmanship and sales techniques. You may know the product inside and out, but maybe your sales presentation wasn’t customized to the prospect’s unique needs. You may know the pricing structure better than anyone else on your sales team, but perhaps the upfront needs analysis wasn’t good enough and the competition asked more relevant questions, allowing them to come up with the perfect pricing solution. Maybe you came from the service side of your business and are selling because you know how good the implementation and on-going service will be, but you exposed limitations because you were unable to involve the right people during the sales process – and the prospect ended up feeling not as important as they wanted.

Anova’s research identifies the areas needing more practice. If you know where you need to improve your fundamentals, you can practice. If you practice, you will improve. If you improve, you will win more business.

“The more a person feels understood, and positively affirmed in that understanding, the more likely that urge for constructive behavior will take hold.”

“The more a person feels understood, and positively affirmed in that understanding, the more likely that urge for constructive behavior will take hold.”

Chris Voss, former lead international kidnapping negotiator for the FBI, knows a thing or two about changing behavior. In his book Never Split the Difference, Voss instructs the reader how to execute a number of his signature negotiation tactics.

Among stories of haggling with terrorists, kidnappers, and even Harvard professors, Voss also brings his strategies to the business world and explains ways business people can change the behavior of the party they are negotiating against. One important step in convincing someone to change their behavior (such as switching from not needing your product / service to buying it) is having the other party feel like their needs are being understood and valued.

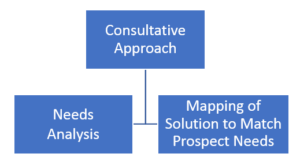

In the sales world, understanding needs is a critical element of what is known as the consultative approach. What is the consultative approach exactly? Think of it as the articulation of how a proposed solution will fill the prospect’s unique business requirements. And in order to successfully map a solution to the prospect’s needs, an effective needs analysis first needs to take place.

Across Anova’s win / loss research, consultative approach is one of the leading indicators of a successful sale. In fact, in one recent study, the client’s win prospects cited consultative approach as the number one strength of the sales team. But in losses, the number one area for improvement was the lack of a consultative approach.

So what does that mean?

For one, it means the client’s sales team was inconsistent in their execution of the approach. But secondly, it means that the data reinforced the notion that a well-executed consultative approach puts the sales team in a very good position to close the deal. If the sales team was able to effectively complete the needs assessment and map their solution to the prospect’s needs, it most likely ended in a win. Conversely, if they were not able to complete those steps, the client was more likely to lose the deal.

So how can sales teams learn to be more consistent in their execution of the consultative approach? Let’s look at one anecdote Voss detailed in his book involving a pupil of his who was trying to close a substantial deal as a sales representative for a large pharmaceutical company.

Voss’s student had had numerous appointments with a hospital trying to sell a doctor a new kind of medication. However, each meeting ended the same way, with the doctor ignoring the salesperson’s pitch and dismissing the product.

Eventually, the student tried a different tactic. Instead of trying to pitch the new medication right off the bat, she started a meeting with a needs assessment.

“They talked about specific challenges [the doctor] had… [The salesperson] learned how her medication would fit into [the doctor’s] practice. She then paraphrased what he said about the challenges of his practice and reflected them back to him.” The salesperson eventually “could tout the attributes of her product and describe precisely how it would help [the doctor] reach the outcomes he desired… She made the sale.”

The salesperson was finally able to successfully close the deal, but only after committing the time to learning about her counterpart and what the customer was trying to accomplish. Voss’s story exemplifies how effective a well-executed consultative approach can be in turning even the stingiest of prospects into a satisfied buyer.

For salespeople in any industry, being able to execute the consultative approach is vital to closing deals. Remember to commit to the needs analysis, as making the prospect feel understood is the important first step in changing their behavior from evaluator to buyer.

A few months ago, we wrote about setting goals for the new year. A few months later it’s time to check-in. How are those resolutions coming? Have you, and your organization, been making progress?

A few months ago, we wrote about setting goals for the new year. A few months later it’s time to check-in. How are those resolutions coming? Have you, and your organization, been making progress?

April, and more specifically the end of Q1, is a great time to check-in on those goals. When we think about goal-setting, our objectives typically fall into one of two categories: short-term and long-term. Similarly, win / loss has both short and long-term benefits.

Think about how a traditional win / loss program is constructed. There are the individual interviews that happen on an ongoing basis, and then aggregate reporting that is done to synthesize insights and discover trends.

Those individual transcripts are a gold mine for individual people on your team. The salesperson can read the voice of the prospect’s commentary about their performance and how well that new sales tactic they tried was received. The pricing specialist can learn if their fee structure was perceived to be transparent or not. The product manager will see a side-by-side comparison of their solution to the competition. There is an incredible amount to be learned from a single debrief, but it is just one data point.

That is where the importance of aggregate findings comes in. Those learnings from the individual transcript are helpful for understanding what happened in a single deal, but need to be looked at in the context of the full data set. That new sales tactic that was tried? It may have worked in one situation, but fell short in the other three afterwards. The fee structure may be transparent to a procurement specialist who is well trained in handling pricing models, but is too complex for business-line personnel to understand. And the product comparison? Products are ever-changing, and a perceived competitive gap in one deal may be narrowed by the next. In order to fully understand how all of the aspects of your offering rate, you need a broader sample set with much more deal flow. Then, looking at the aggregate results can help decision makers pinpoint where the actual areas for improvement are.

In many public companies right now, sales teams are reviewing the last deals that counted towards their early-year quotas, and finance and accounting teams are getting ready for the scramble of calculating quarterly earnings. They are focused hitting their short-term goals. Meanwhile in the board rooms upstairs, executives are monitoring those short-term numbers, while also trying to measure the successes of the first three months against their long-term plans. Take a similar approach to your win / loss program. Keep focused on the individual deals and their learnings, but don’t lose sight of the forest for the trees, and remember the power of the broader program-wide results.

At the beginning of the year, we discussed the theme of goals. We talked about setting the bar high for yourself and your organization, and also about achieving those objectives. And while goals and aspirations are certainly very personal endeavors, it is important to note that win / loss isn’t just about you. It’s also a useful tool for understanding your customers’ goals.

At the beginning of the year, we discussed the theme of goals. We talked about setting the bar high for yourself and your organization, and also about achieving those objectives. And while goals and aspirations are certainly very personal endeavors, it is important to note that win / loss isn’t just about you. It’s also a useful tool for understanding your customers’ goals.

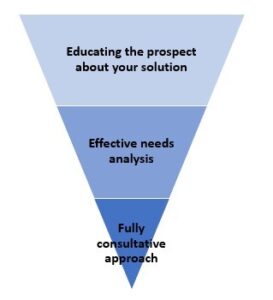

Fully understanding your prospects’ needs is a quintessential step in any complex, high-dollar value sale. Anova’s research has repeatedly pinpointed a lack of effective needs analysis and / or consultative approach as one of the top reasons why our clients lose specific deals. Those two areas: understanding the prospect’s unique needs and mapping your solution to those points, is easy to talk about doing, but difficult to consistently execute.

When you are looking at an individual transcript from a win / loss interview and analyzing the performance of the sales team, think of a funnel, or an upside down pyramid, with three key attributes:

Unsurprisingly, Anova’s data from our clients’ loss situations shows an ineffective or inconsistent execution of all three phases of this sales pyramid. But, that is also where win / loss is helping them.

Questions such as “what were the most important attributes you were looking for at the beginning of your search?”, “what did the sales team do well / not well?” and “did the sales team clearly articulate and map their value proposition to your needs?” will help uncover what the prospects goals were in finding a new solution, and how effective the sales team was at addressing those needs and helping the prospect achieve their goals.

Do you have visibility into how effective your sales team is at all three phases of the sales pyramid?

“People think focus means saying yes to the thing you’ve got to focus on. But that’s not what it means at all. It means saying no to the hundred other good ideas.”

“People think focus means saying yes to the thing you’ve got to focus on. But that’s not what it means at all. It means saying no to the hundred other good ideas.”

If you’re in product management, that quote from Steve Jobs probably means something to you.

As a product manager, do you feel pressure to say yes to everything your customers or co-workers want to see in your products and services? Do you ever feel like saying no to more product wish lists and wants? Of course you do. You can’t do everything at once, after all. At the end of the day, focus is critical in product management.

Think of how many constituents influence your product and service roadmap: your organization’s leadership, your sales team, your client service members and relationship managers, your current customers, your departed customers, and yes, even your prospects.

How do you keep all these voices satisfied while creating products and services that will help your organization meet its revenue goals and its customer service goals? It comes back to focus.

Your primary role as product manager should involve two key tasks – one, setting a long-term vision and strategy for your products and services; and two, communicating that vision and strategy to all those voices.

Sourcing, gathering, and studying data from these voices will help you – the product manager – focus on this vision and strategy. Collaborating internally most likely happens routinely within your organization through scheduled one-on-ones, team meetings, and cross-department meetings. You are probably not falling short on feedback or those wish list items from internal sources. Allow those data sources to contribute to your product decisions.

For those external sources – your clients (current and departed), your prospects, and your competitors – you need to find a way to gather that data. How can those voices contribute to your process? Sourcing this kind of business intelligence is fundamental to building your product roadmap.

One tool that you can use to help gather business intelligence is win / loss research. Most often thought of as a sales tool or a sales performance service, win / loss research goes beyond just sales. It supports product management by its very nature – to help organizations understand why they are winning and losing in new sales situations as well as to help organizations understand what its competition is doing in those same sales engagements. And if your products and services sit at the base of each sales situation (win or loss), why wouldn’t a win / loss program become part of your success story?

Sales leadership takes a special type of person – someone who can lead and teach interchangeably. A successful sales leader needs to know how to sell, inspire, and coach. A sales leader relies on his or her team to chase growth and convert prospects to clients on a never-ending trajectory. There are always new deals to close, and more revenue to chase.

Sales leadership takes a special type of person – someone who can lead and teach interchangeably. A successful sales leader needs to know how to sell, inspire, and coach. A sales leader relies on his or her team to chase growth and convert prospects to clients on a never-ending trajectory. There are always new deals to close, and more revenue to chase.

How does a successful sales leader keep a team focused and motivated? Setting the tone is key. It is crucial that a sales leader – be it the head of sales, a regional vice president, or territory manager – commits to the continuous improvement of each salesperson. With a focus on personal improvement, a sales leader can encourage collaboration, talk openly about what’s working well and what is not, and help sales professionals reach personal goals. In fact, when a sales leader commits to continuous improvement, the impact reaches all areas of the organization. Everyone wins.

Win / loss research is a vital tool for successful sales leaders. Win / loss has many objectives, but increasing a team’s win rate is the ultimate goal. The process can help sales leaders acquire valuable perspectives such as:

Win / loss results also can be used as a coaching tool with individual salespeople. Sales managers can become a fly on the wall in each and every deal there is a debrief for, and can use the voice of the prospect to provide precise and accurate feedback on how salespeople are doing their jobs.

Reading and hearing candid feedback from clients and prospects is invaluable for a salesperson because it enables him or her to make adjustments and calibrate his or her sales techniques to the evolving competitive dynamics of the marketplace. Successful sales leaders know that win / loss research actually improves sales teams’ performance and win rates. In fact, win / loss clients generally experience substantial increases in their sales performance.

Brian Tracy, renowned author and sales coach, puts it best: “Your life can only get better when you do. Do something every day to improve your key skill areas.” Win / loss research helps sales leaders do just that.

Note: This blog was written by Ellie Mirman, CMO at Crayon, a market and competitive intelligence company that provides insights and inspiration for marketers.

Note: This blog was written by Ellie Mirman, CMO at Crayon, a market and competitive intelligence company that provides insights and inspiration for marketers.

Businesses today have great internal visibility – into their funnels, websites, and roadmaps – and many tools and data to evaluate those internal efforts. But when it comes to understanding and acting on what’s happening externally – with competitors, customers, and partners – most companies are radically underinvested.

How are competitors shifting messaging and positioning? What are the most meaningful product and pricing changes in your market? Are companies in your space shifting marketing investment to new platforms? What’s their hiring plan? What’s their partner strategy? Are they winning or losing customers at an accelerated rate? What content strategies are working for them? Most companies can’t answer these fundamental questions.

What is Market Intelligence?

Market intelligence (MI) is information relevant to a company’s market – specific industry or product area – for use in strategic and tactical decision-making to achieve the company’s goals. Market intelligence includes data on one’s competitors, customers, partners, thought leaders, and other variables that can influence market success.

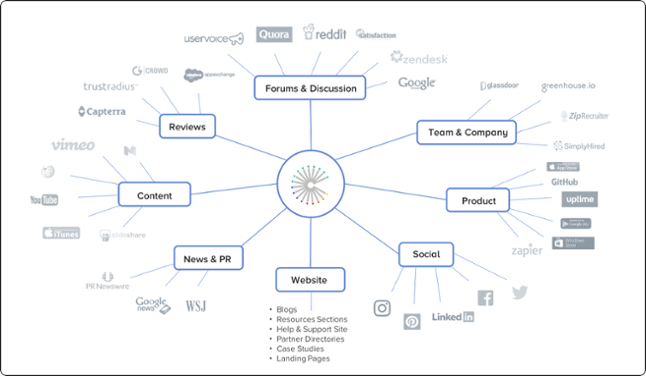

This intel is hidden everywhere – across a company’s website, online forum threads, review sites, and job boards. There’s an incredible wealth of information available online that can be used to get insight into competitors’ strategies and programs.

Increasing Adoption of Market Intelligence

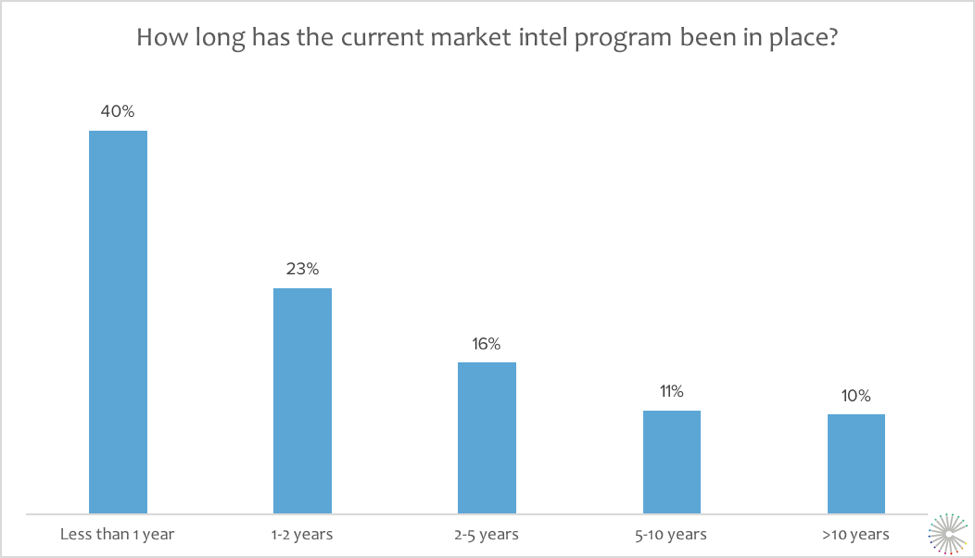

More and more companies are committing resources to market intelligence – in fact, 94% of large companies are doing some market intelligence and 80% have whole teams dedicated to it. At the same time, we’re still in the early stages of companies learning how to build out effective MI programs — 40% of these programs have been in place for less than one year and only 22% have goals.

How to Build a Market Intelligence Program

If your business, like many out there, is just getting started with market intelligence, here are some key questions to answer to build out this new program.

The vast majority of companies haven’t awakened to the market intelligence opportunity yet. That’s great news for you! You can be first in your market to use actionable market intelligence to build a sustainable competitive advantage.

There’s a good chance if you don’t make the investment soon, someone else in your market will beat you to the punch. By the time you see their case study, you’ll be playing catch-up. Instead, you could have your rivals read a case study about how you won with market intelligence.

About Crayon

Crayon is a market intelligence platform that enables businesses to track, analyze, and act on everything happening outside their four walls. Tens of thousands of teams use Crayon’s software to capture and analyze complete market intelligence, pulling from more than seven million sources. Crayon was founded in 2014 by former HubSpot and AdMob executives who believe that millions of businesses have yet to take advantage of the intelligence data available today to drive actionable insights and opportunities. To learn more about Crayon, visit www.crayon.co.

The beginning of a new year invites us all to think about everything we accomplished over the previous twelve months, and more importantly, all the goals we want to achieve in the new year.

The beginning of a new year invites us all to think about everything we accomplished over the previous twelve months, and more importantly, all the goals we want to achieve in the new year.

What does your vision for 2018 look like? We all know gym memberships and personal finance milestones typically spring to mind, but what about your professional goals?

Are you looking to increase your win rate in sales situations? Train the next generation of salespeople? Improve client retention and loyalty? What about impacting your organization’s top and bottom lines in a meaningful way?

There will always be personal trainers waiting at the gym for you, or financial advisors willing to help you meet your personal resolutions, but do you have the right partner to help with those professional goals?

Many companies look to outside help from professional services companies to accomplish their goals. There are several third-party research offerings that provide the necessary feedback and training to unlock the data and insights needed for change and growth in 2018.

Consider these professional training tools:

Research has shown over 90% of people don’t achieve their personal New Year’s resolutions. No one will blame you if that gym membership goes unused or you stop appointments with your financial advisor. However, when you are trying to take the next step in your professional development, and participate in the growth of your organization, it makes a lot of sense to leverage the above tools to help you achieve your goals. Think of them as your professional trainer for 2018.

How much is one sales meeting worth to your business? Sports merchandise powerhouse Nike is finding out the hard way that not treating every pitch as significant can have major ramifications. In a recent ESPN article, reporter Ethan Strauss unveiled the story of the courtship for reigning NBA MVP Steph Curry by top sponsors Nike and Under Armour. Readers of the article learned cringe-worthy details of how the top sports brand in the world lost an athlete worth an estimated $14 billion to one of their top competitors. What readers might not have realized, however, is how prevalent the same mistakes that plagued Nike are in sales situations. Let’s take a closer look at how Nike turned off one of their most promising young stars, and violated several cardinal rules of sales.

In 2013, Nike met with Curry, who was a current client at the time, in order to sign him to a contract extension. Instead of bringing their top brass, however, Nike chose not to include one of their chief athlete advisors, suggesting to Curry that Nike did not feel he was important or relevant enough to warrant the additional attention. As Anova has learned through thousands of Win / Loss interviews, having the right personnel at sales presentations is absolutely critical to making prospects (and in this case existing clients) feel important and valued. Not having their top personnel at the meeting was a bad first step, but pales in comparison to the rookie mistakes made by the Nike officials that were present.

The Nike presentation was also lacking in customization. Included within was a slide with Kevin Durant’s name instead of Curry’s, indicating the PowerPoint shown to Curry was merely a reprocessed presentation of one given to another Nike athlete. To add insult to injury, one Nike official was said to have mispronounced Stephen’s name. Between the recycled PowerPoint and calling Curry by the wrong name, Nike failed to make their client feel valued. The inability to make a client (or potential client) feel important is consistently one of the top sales weaknesses cited by respondents in Win / Loss surveys. In this case, it cost Nike considerably.

Unfortunately, unprepared sales teams and uncustomized presentations cost businesses hundreds of thousands of dollars in potential revenue annually. In 2015 alone, Anova identified ineffective sales performance as a reason for losing bids in almost 50% of all situations!

The real question is: can your organization afford to NOT be more prepared than Nike was?