Anova Consulting believes that one of the keys to success lies in the ability to adapt and learn from the challenges we face. These shared beliefs, essentially our corporate ethos, are values we strive to put into action every day. This is the fourth in a series of blogs that explore Anova’s values through the lens of people we feel embody them.

Anova Consulting believes that one of the keys to success lies in the ability to adapt and learn from the challenges we face. These shared beliefs, essentially our corporate ethos, are values we strive to put into action every day. This is the fourth in a series of blogs that explore Anova’s values through the lens of people we feel embody them.

Cultivating a strong company culture is critically important to ensure a company’s long-term success. Warren Buffett, CEO of Berkshire Hathaway, is renowned for many things. But near the top is his firm belief in the power of a positive company culture. He has built his own company around this very principle.

At the heart of the Buffett approach is that a strong company culture begins with the idea of “good people, great team.” Building a team of talented, motivated, and ethical individuals with shared values and goals is essential to creating a positive work environment. He believes it’s vital to hire people not simply based on their skills and experience but on their cultural fit with the company.

Buffett emphasizes professional development and mentorship. He often takes top executives under his wing and encourages them to develop their own investment philosophies. This has helped to create a culture of innovation and autonomy within Berkshire Hathaway, where employees feel empowered to make decisions and take risks.

Transparency and ethics are other important elements of Buffett’s approach to fostering a positive company culture. He refuses to invest in companies that engage in unethical or illegal practices, and he emphasizes the importance of being transparent with stakeholders. This approach has helped him build trust and credibility with customers, investors, and employees.

Buffett also places great importance on creating a sense of community for his employees. He believes that nurturing strong relationships among team members creates a supportive and engaged work environment. This includes encouraging coworkers to spend time together outside of the office and providing opportunities for team-building.

Anova believes the “good people, great team” ethos and strives to put it into practice with professional development, ethical behavior, transparency, and community-building. We also notice these elements in the company cultures of our most successful clients.

Anova Consulting believes that one of the keys to success lies in the ability to adapt and learn from the challenges we face. These shared beliefs, essentially our corporate ethos, are values we strive to put into action every day. This is the third in a series of blogs that explore Anova’s values through the lens of people we feel embody them.

Anova Consulting believes that one of the keys to success lies in the ability to adapt and learn from the challenges we face. These shared beliefs, essentially our corporate ethos, are values we strive to put into action every day. This is the third in a series of blogs that explore Anova’s values through the lens of people we feel embody them.

Craftsmanship, defined as the mastery of a skill through patience, discipline, and continuous improvement, is exemplified by masterful talents that spend years honing the skills required to become exceptional in their field. Julia Child, the celebrated chef who dedicated her life to perfecting the art of French cuisine, exemplified craftsmanship.

Child’s passion for cooking began late in life when she moved to Paris with her husband. She enrolled in the renowned Le Cordon Bleu culinary school, where she spent years perfecting her skills in the art of French cooking. She was known for her meticulous attention to detail and her commitment to learning the complex techniques and flavors of the cuisine. She famously (and patiently!) practiced making omelets for weeks, each time making only slight adjustments to achieve perfection.

After leaving Le Cordon Bleu, Child teamed with two French colleagues to write Mastering the Art of French Cooking, a cookbook that would soon become a classic in the culinary world. The process of writing the book was itself an exercise in craftsmanship, as Child and her colleagues tested and retested recipes to ensure accuracy and quality. There were no shortcuts.

At Anova, we also believe there are no shortcuts. We take a long-term view of success, and we too pay special attention to craftsmanship. Like Child, we strive to maintain a quest for continuous improvement, and we understand that the key to mastery is not just in acquiring a skill but in applying it repeatedly and evolving with changing times and market conditions.

Many of our clients have integrated a similar quest for continuous improvement in the evolution of their “voice of the client” programs. They understand the importance of patience and discipline in pursuing excellence, and they value the art of craftsmanship as much as we do.

Anova Consulting believes that one of the keys to success lies in the ability to adapt and learn from the challenges we face. These shared beliefs, essentially our corporate ethos, are values we strive to put into action every day. This is the second in a series of blogs that explore Anova’s values through the lens of people we feel embody them.

Anova Consulting believes that one of the keys to success lies in the ability to adapt and learn from the challenges we face. These shared beliefs, essentially our corporate ethos, are values we strive to put into action every day. This is the second in a series of blogs that explore Anova’s values through the lens of people we feel embody them.

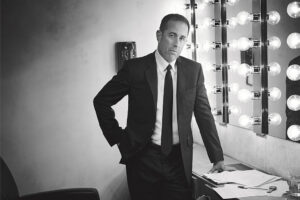

Jerry Seinfeld’s success in the comedy world can, in part, be attributed to his relentless pursuit of feedback and his commitment to using that feedback to hone his stand-up craft.

In his book Seinlanguage, Seinfeld describes how he would always carry a small notebook with him to jot down observations and ideas that he could later consider for his comedy bits. He constantly ran these ideas by fellow comedians and writers, asking for feedback on his material and delivery. The comedian viewed feedback as essential for growth and improvement, and he remained open to constructive criticism.

Seinfeld also embraced feedback in his approach to testing new material. He repeatedly performed new jokes in smaller clubs to gauge the audience’s reaction and make adjustments as needed, often in real-time. This allowed him to hone his material before trying it on large audiences.

His openness to feedback as a tool to refine his craft has paid off in many ways, including multiple Emmys for his hit television show. Seinfeld continues to perform his stand-up routine to sold-out crowds worldwide, and his willingness to improve his material and delivery has solidified his place in comedy history.

At Anova, we share Seinfeld’s belief that feedback is integral to our process. Whether we’re conducting win / loss surveys, or customer satisfaction research, we know that feedback—while sometimes tough to hear—is a gift and an invitation to even greater growth and success.

Anova Consulting believes that one of the keys to success lies in the ability to adapt and learn from the challenges we face. These shared beliefs, essentially our corporate ethos, are values we strive to put into action every day. This is the first in a series of blogs that explore Anova’s values through the lens of people we feel embody them.

Anova Consulting believes that one of the keys to success lies in the ability to adapt and learn from the challenges we face. These shared beliefs, essentially our corporate ethos, are values we strive to put into action every day. This is the first in a series of blogs that explore Anova’s values through the lens of people we feel embody them.

The key to success lies in the ability to adapt and learn from the challenges we face. It requires the courage to push beyond our comfort zone and embrace adversity with a positive attitude. This approach, known as a “growth mindset,” is illustrated in the work of Carol Dweck, an acclaimed Professor of Psychology at Stanford University.

Dweck’s research highlights the importance of overcoming obstacles, seeking feedback, and believing in the ability to improve performance with hard work and effort. Her work has practical applications in many fields, including education, business, and sports. In her education research, for example, students willing to persevere through difficult tasks improved their grades and developed a love for learning. Similarly, in business, employees who are adaptable, innovative, and resilient in the face of change are also more likely to succeed.

Dweck’s own story is a testament to the power of a growth mindset. She began her academic career as a music major but switched to psychology after discovering her passion for understanding the mind and human behavior. Despite not having a background in psychology, she pursued her interest and eventually became one of the most influential psychologists of her time.

What can we learn here? First, we should have the courage to embrace challenges and to view obstacles as opportunities for growth. Second, we should cultivate a love for learning and be willing to adapt and innovate to remain relevant and successful. Finally, we should maintain a positive attitude and truly believe in our ability to succeed, even in the face of adversity. Anova’s most successful clients embody these qualities to stay competitive and achieve long-term success.

This is the fourth installment in a series of blogs discussing how sales teams win more by demonstrating value through taking a consultative approach. The previous installment explored how sales teams can be more consultative by clearly understanding prospects’ unique needs. This installment discusses a second way sales teams can be consultative. This blog was written by Yosen Wang, Analyst.

Customize Product Demonstrations and Presentations

Customize Product Demonstrations and Presentations

It is said that communication is not the words one says, but rather what the audience understands. Once sales teams have done their homework and possess a clear understanding of prospect needs, they must communicate that understanding to their customers. In this data set, successful sales teams communicated understanding of customer needs by tailoring the content of presentations and product demos to specifically address how their solution can solve customer problems and achieve prospects’ goals.

Customization enforces a commitment to the Client and alignment with buyer search criteria. For example, one customer from a winning situation expressed their appreciation for the customized sales process:

The [client] sales team listened to our needs and tailored its presentations to show how [client] would solve our particular needs. Instead of wasting time on lengthy company introductions or on features and functionality that are unimportant to us, the [client] sales team heard what we wanted. It focused on our needs and how [client]would address and solve them.

In another successful presentation, feedback emerged that:

The sales team showed us exactly what requested with the various scenarios that we had asked them to show us. This demonstrated to us that they understood and could address our functional needs.

These two teams approached their presentations from a customer-centered stance, and feedback from prospects illustrates they understood the effort the sales teams took to both research their needs and personalize their presentations to fit those needs.

Click here to read the full case study.

This is the third installment in a series of blogs discussing how sales teams win more by demonstrating value through taking a consultative approach. The first two blogs established how sales teams win more by demonstrating value. Additionally, taking a consultative approach is vital to demonstrating value. This installment discusses the first of three specific ways sales teams can strive to be more consultative. This blog was written by Yosen Wang, Analyst.

Clearly Understanding Buyer Needs

Clearly Understanding Buyer Needs

Consultative sales teams first thoroughly understand the buyers’ specific, unique needs. When Clients won, their perceived ability to understand customer needs was nearly unanimously rated as superior to the top competitor. Understanding buyer needs is the foundation for being consultative as it is the first step to tailoring messaging about how a software solution can solve for those specific needs, thereby creating value and driving wins.

Winning teams approached sales engagements with a customer-centric approach, in which helping to solve the goals of their prospect took precedence over showing off their own solution’s capabilities, some of which may not be important to the prospect’s needs.

Qualitative feedback further supports this idea. For instance, one customer noted in a Client win interview:

The sales process was much more personalized with [client] than with the others. [client] took the time to understand our objectives and come up with what we needed to achieve and what we wanted to achieve. We felt that the other two vendors were trying to change our minds on what we needed in order to fit their product.

Similarly, another prospect cited the ground-up approach a successful sales team took:

We found that [client] has a very different approach to prospective customers. They started from a blank sheet and said, how do we help businesses solve problems in this area? They felt that if they could solve your business problems, the software would sell itself. I feel like others start with a number of seats and then try to figure out how they can get businesses to buy that number of seats.

Customer verbatims illustrate that when prospects’ needs are understood, it not only helps fuel the ability of the sales team to be consultative, but it also enhances the connection the customer feels to the sales team, helping the customer feel comfortable awarding that sales team their business.

In contrast, unsuccessful sales teams often do not take the time to ask the right questions about a prospect’s needs. If they do not ask these important questions, sales teams lose the opportunity to build rapport and connections with the prospect. They also sacrifice valuable information to be used throughout the rest of the sales process. For example, a lost software prospect commented:

[Client]’s approach was to show us everything they offered before finding out what we really needed. I think a better approach would have been to give us a short overview of their offering and then give a more focused presentation and demonstration of the important functions. I was left with the impression that [client]’s solution was all or nothing, and it did not feel like they understood our needs.

Once sales teams have a clear understanding of prospect needs, they are ready to communicate that understanding by customizing sales presentations and demonstrations to address those needs.

Click here to read the full case study.

This is the second installment in a series of blogs discussing how sales teams win more by demonstrating value through taking a consultative approach. The first blog established how sales teams win more by demonstrating value. This blog was written by Yosen Wang, Analyst.

The Importance of a Consultative Approach

The Importance of a Consultative Approach

In order to convince prospects of the value of their solution, sales teams need to effectively assess customer needs and deliberately articulate how their solution can solve those customer needs. In other words, sales teams need to take a consultative approach.

Two pieces of data illustrate how influential a consultative approach can be in whether a sales team wins or loses:

Consultative approach is also directly linked with value articulation. In situations in which satisfaction with expected value / ROI was rated higher than that of the competition, 89% also rated the sales team’s consultative approach as better than the competition.

How Can Sales Teams be More Consultative?

Taking a consultative approach entails three vital principles: clearly understanding the buyer’s unique needs, carefully demonstrating how their solution’s capabilities meet those needs, and effectively differentiating it from competing solutions.

Click here to read the full case study.

In a recent blog for The Pragmatic Institute, Anova Senior Research Analyst Will Young authored a blog providing information for organizations about interpreting win / loss data. Below is an excerpt:

In a recent blog for The Pragmatic Institute, Anova Senior Research Analyst Will Young authored a blog providing information for organizations about interpreting win / loss data. Below is an excerpt:

All win/loss programs collect data.

That data can come in many different forms: internal CRM codes, feedback from internal interviews, results from web surveys, or, when done correctly, in-depth interviews with independent third-party consultants.

The latter, interviews conducted by third-party consultants, are an effective approach for collecting win/loss data, because the data is gathered by experienced interviewers and includes both qualitative and quantitative feedback about a company’s sales effectiveness, product/service offering, pricing, and overall competitiveness in the marketplace.

To accomplish this task, there first needs to be an in-depth analysis. Strategies like analyzing the information, segmenting the findings or results and benchmarking against relevant competitors and industry peers all help identify important themes and accentuate valuable findings.

While completing the analysis is an important exercise, the overarching story that results from that analysis is what will ultimately drive change and help companies win more business.

To read the full blog, click here

In a recent blog for The Pragmatic Institute, Anova Senior Research Analyst Will Young authored a blog providing information for organizations about the benefits of a win / loss program. Below is an excerpt:

In a recent blog for The Pragmatic Institute, Anova Senior Research Analyst Will Young authored a blog providing information for organizations about the benefits of a win / loss program. Below is an excerpt:

Knowing which of your distinctive competencies are being recognized by the marketplace allows you to adjust your marketing and sales strategies accordingly.

And understanding your customers’ perspectives and what separates you from your competitors is integral to improving your win rate.

To obtain this knowledge, however, you need an effective customer listening tool.

Win/loss programs are essential tools for capturing and understanding the voice of the customer.

When considering the importance of understanding distinctive competencies, there are two main ways a win/loss program can help:

The best win/loss programs collect a mix of both qualitative and quantitative feedback. Each of these questions elicits valuable data about how unique a company’s positioning and offerings are in the marketplace.

Asking open-ended qualitative questions allows companies to understand their customers’ true opinions. Rather than biasing respondents by asking about a company’s postulated differentiators directly, you’ll gain immense value by leaving the related questions more open-ended. A question included in many of Anova’s win/loss programs is:

“What, if anything, did our client do to differentiate itself from the competition during the sales process?”

By leaving this question open-ended, with no prompting and no biasing, the company can be confident that the responses are the prospects’ true top-of-mind opinions.

To read the full blog, click here

Note: This blog was written by Ryan Ashe, a Research Analyst at Anova.

Note: This blog was written by Ryan Ashe, a Research Analyst at Anova.

Introduction

In the same way that watching game film on an ongoing basis enables sports coaches to lead their teams to success, win/loss enables sales leaders to practice, analyze, and strategize on a regular cadence. At Anova, we find that companies that conduct win/loss on a regular basis, as opposed to merely implementing a one-off program, get the most value from the feedback. Taking advantage of a regularly scheduled win/loss program enables businesses to more effectively track changes in market perceptions over time and monitor a consistent flow of competitive intelligence. Additionally, implementing an effective win/loss program on a regular basis has the power to positively affect an organization’s culture by providing feedback that promotes stronger leadership, incentivized employees, and overall business growth. Some companies are hesitant to implement an ongoing win/loss program; but, organizations can reduce this hesitancy and reap the benefits of an ongoing program by framing negative feedback as an opportunity to grow and celebrating positive feedback.

The Benefits of an Ongoing Win/Loss Program

An ongoing win/loss program provides critical feedback that is readily available through interview transcripts and aggregate analytics. Having an ongoing feedback loop like this enables companies to track changes in both individual and organizational performance over time. Additionally, when done on an ongoing basis, the win/loss interviews provide a constant source of valuable competitive intelligence. Lastly, the regular availability of win/loss interview transcripts presents a unique opportunity to understand prospect perceptions and for a company to adjust to any misalignments between the marketplace and the company’s pitch. If a win/loss program is implemented for only a brief period, the window of opportunity for understanding prospect perceptions becomes reduced. An ongoing win/loss program allows business leaders to have a constant pulse on how their organization is being perceived in the marketplace, which enables leaders to make strategic adjustments in real-time. Ultimately, this results in a company being able to act on the feedback more easily and win more business.

Barriers to Implementing an Ongoing Win/Loss Program

It is human nature to avoid feedback. Even those with growth mindsets who initially want feedback can bristle when actually receiving the criticism. Sometimes organizations who want to “talk the talk” ultimately don’t want to “walk the walk” after receiving feedback. Other times, at the end of an engagement, we hear leaders say that they would like more time before conducting win/loss again so that they can improve the vulnerabilities that the initial win/loss program identified. This approach to win/loss is analogous to watching game film in the preseason, identifying areas for improvement, and then solely focusing on those areas of improvement from the preseason for the entire regular season. This is not the approach that winning organizations take. Taking a hiatus from receiving feedback allows the competition to catch up. Winning organizations do everything they can to prevent this, including constantly seeking feedback, even at the top of their game.

Overcoming These Challenges

With over 25 years of experience helping clients implement win/loss programs, Anova has gained a deep understanding of how to overcome any aversion to feedback that may exist within an organization. The key to developing a culture that embraces feedback is in how the feedback is framed. Even within organizations with highly functioning sales teams, it is inevitable that over the course of a win/loss program, negative feedback will arise. In these instances, it is crucial that leaders use the interview transcripts as coaching tools. Much like watching game film after a disappointing loss, interview transcripts that contain negative feedback present an opportunity to grow. Leaders should seize these opportunities by setting up meetings with the team that worked on the deal and walking them through what went wrong and how these mishaps can be corrected the next time around. The emphasis should be on the fact that this negative feedback will help the team win more deals in the future, and the transcript should not be used to shame individual team members. Salespeople are competitive by nature; they hate to lose and do not necessarily need constant reminders of their shortcomings. Leaders should capitalize on this competitive nature by framing these meetings as opportunities to become more competitive. This will reduce the anxiety that often comes with the anticipation of negative feedback. Win/loss interview transcripts also present a unique opportunity to understand the perceptions of the prospect. We often encounter situations where the buyer’s perceptions of a deal do not align with the perceptions of the sales team that worked on the deal. Seeing feedback from the buyer that the sales team feels does not align with reality could make the sales team defensive. In these situations, it is crucial for leaders to make it clear that in situations where differences do exist, it is less important as to who is “right” and more important to understand why those differences exist in the first place. Understanding the differences in perception is essential in order to refine the team’s pitch, so it better resonates with prospects in the future.

Ultimately, as improvements are made over time, and the team wins more deals because of time spent dissecting negative feedback, the culture of the organization will begin to shift. Salespeople will begin to crave win/loss interview transcripts on an ongoing basis and recognize them for what they are: a competitive tool that is key to winning more business.

At Anova, we have also found that acknowledging positive feedback is equally as important as unpacking negative feedback. Win interview transcripts are often rich with praise for what an organization’s sales team did well in order to beat the competition. In these instances, it is essential that leaders celebrate this praise by calling out strong individual performances or areas where the team has made the improvements that were shown to be necessary through loss interview transcripts. This celebration of strong performance helps to build a culture that embraces feedback by creating a sense of positivity around the win/loss program. The bottom line is that if leaders are emphasizing the value of dissecting negative feedback and asking their team to buy in and embrace the feedback, it is also their responsibility to make known the positive impact that analyzing the win/loss feedback is having on the organization. Win interview transcripts often present the perfect opportunity for leaders to make this happen.

Conclusion

Anova believes strongly in the importance of an ongoing win/loss program because it enables organizations to more effectively track changes in how they are being perceived in the marketplace over time. The constant flow of both positive and negative feedback creates a fluid source of competitive intelligence that helps the organization gain an edge in the marketplace. In order for a program to be successful, however, organizations must be open to embracing feedback, both positive and negative. While feedback can be unnerving for some who feel that it will expose problems and promote finger-pointing, successful companies learn how to use this feedback to their benefit to create a winning culture. Eventually, employees look forward to the continuous win/loss feedback because they see it as a means of improving their performance, and business leaders view the program as a tool to grow the business and become more profitable.