“How did we lose that deal?!” or “Why did our competitor win over us?” These are common questions sales leaders ask their teams, and they are fair questions—business leaders need honest answers to win the next deal.

When a salesperson asks a decision-maker why they won or lost a deal, the truth is often disguised or not shared at all. In fact, salespeople only know the exact reasons behind a decision 40% of the time. At Anova, we work to close this gap by conducting Win-Loss interviews as a neutral third-party. One of the key questions we ask is, “What were the top three reasons for your decision to choose the winning provider?”

By aggregating this feedback, a story emerges. Our analysis helps clients understand what they did well when they won and where competitors outperformed them in losses. This raised a key question for us: What do these stories tell us about the attributes that drive buying decisions?

Mature vs. Growth Markets

To answer this, we grouped companies into two categories:

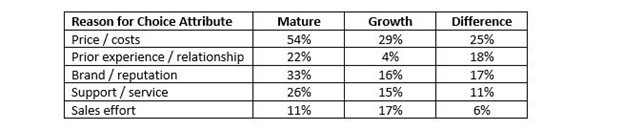

When analyzing aggregate data, key trends emerged. The top five decision-making attributes with the greatest differences between these market types were:

The percentage of time each of those attributes were mentioned as a reason for choosing a provider can be seen in the table below:

This data reveals that there are real differences between the two industry types. If one were to rank the attributes in each market separately, price, brand and service are the three most important decision criteria in Mature industries, but price, sales, and brand have the most influence over decisions in Growth markets.

In summary:

Price is the most frequently mentioned attribute in each market and also has the widest disparity in mentions, signaling a difference in how influential costs can be.

If you are in sales, you are most likely goal-oriented and performance-driven. Your ability to win business – to convert leads into closed business situations – becomes your report card. And if you are a successful salesperson (or working to become one), you most likely focus on your new situations and pipeline, constantly working the sale and finding the path to closing that piece of business.

If you are in sales, you are most likely goal-oriented and performance-driven. Your ability to win business – to convert leads into closed business situations – becomes your report card. And if you are a successful salesperson (or working to become one), you most likely focus on your new situations and pipeline, constantly working the sale and finding the path to closing that piece of business.

How would you like to put yourself ahead of the rest?

Win / Loss Analysis is a game changer. No longer are you just looking at a scoreboard – how many deals did you close and how many did you loss? Win / Loss takes you beyond the score and moves into your performance, helping you learn the real reasons that drove a prospect to a certain decision.

This is information you need to know. The most important way to close more business is to learn what your clients and prospects are thinking at every stage of the sales experience. With this intel, you can move ahead of your competition by using real, actionable feedback to improve your performance in the next opportunity.

A Win / Loss program will help you:

In the current competitive market, success goes beyond simply keeping score of wins and losses. Sales professionals aiming to stay ahead of the curve are turning to Win / Loss Analysis for a deeper understanding of their performance. A Win / Loss program not only helps improve messaging and effectiveness but also sheds light on competitors’ successes and identifies drivers for closing new business. This approach encourages continuous improvement across the entire sales process, from initial rapport-building to sealing the deal, empowering sales professionals to enhance their performance and increase their chances of winning business. Consider how elevated your sales activity could be if you were receiving in-depth, post-sales debriefs after each and every decision in your pipeline.

So how can you best use Win / Loss for sales success? Try some of these helpful resources:

From a Good Sales Call to a Great Sales Call

Win / loss may seem simple: close a deal, call the buyer, find out why they selected you or a competitor. At a high level these steps may seem straightforward, but they are a lot more complicated than what meets the eye.

Win / loss may seem simple: close a deal, call the buyer, find out why they selected you or a competitor. At a high level these steps may seem straightforward, but they are a lot more complicated than what meets the eye.

While debriefing with every single opportunity is a noble objective, it is unrealistic. If you have the right best practices though, you can select the right prospect organizations and the right contacts to engage with, and get on your way to developing a strong feedback mechanism. The following best practices can get you started:

At the Deal / Opportunity Level

There are a multitude of ways to segment or filter your deal-flow by in order to decide which of your prospects to call on. Here are some of the most beneficial to successful win / loss programs:

At the Contact Level

After deciding which deals to focus on, it is critical to make sure you speak with the right person at the prospect organization. Often in complex sales situations there is one key buyer, but many influencers from numerous different departments: the relevant line of business, IT, finance, and of course, procurement.

To gather the best win / loss feedback, remember to not get stuck in procurement. While the procurement department may have influence, they are often limited in the level of detail they can provide when describing the prospect’s full buying criteria and evaluation process. Getting in touch with the ultimate decision maker is the absolute best practice, as they will be able to provide access into their mindset throughout the sales process and ultimate decision.

In some scenarios there are heavy influencers or more than one decision maker, for instance a consultant may have been involved, or both IT and the line of business in a software sale. In these situations, it can be beneficial to interview multiple constituents to obtain the most well-rounded feedback possible.

After identifying who to contact for your interviews, remember some of the best practices for actually having the conversation with them. But by following the best practices above, you’ve already completed half the battle of conducting a win / loss interview.

Anova Consulting Group provides market research and consulting services to a broad range of 401(k) providers, investment managers, enterprise software companies, and human capital management firms. We are experiencing rapid growth and seek an exceptional individual to join our tight-knit team for a full-time market research position. Anova is based in Brookline, MA (accessible to MBTA C / Green Line and buses). Qualified candidates will have:

Primary responsibilities include:

Participating in design and administration of custom primary market research programs, including:

Managing client relationships on a day-to-day basis, including:

Send a resume to Jamie Zielinski at jamieZ@anovaconsulting.com. No phone calls please.

Established in 2005, Anova Consulting Group is a leading market research and consulting firm focused on Win Loss Analysis, Win Loss Research and client satisfaction analysis. By helping clients understand why they win, lose and retain business, Anova provides strategic perspectives to its clients, driving better decision-making, product development, sales effectiveness, client service, and continuous improvement.

For Immediate Release

Contact:

Andrew Cloutier

Anova Consulting Group, LLC

(617) 731-1045

andrew@anovaconsulting.com

Brookline, MASS. October 18, 2016 – Anova Consulting Group, a leading provider of Win Loss Research and Win / Loss analysis and client retention analysis to industry leading financial services, technology, and healthcare companies announced the addition of Jack Ryan as a research analyst.

Prior to joining Anova, Jack gained work experience at Standish Management and Gurnet Consulting. He is a graduate of Williams College, where he earned a BA in Economics and was recognized for his leadership as a four-year letterman on the Williams football team.

Jack will be focused on the day-to-day execution of Anova’s custom market research programs, as well as analysis of aggregate program data to identify actionable insights for clients. He will cover clients in the financial services, enterprise technology, and healthcare market verticals.

“In the competitive and rapidly changing markets that Anova covers, we are experiencing ever-increasing client demand for more information in a faster timeframe,” said Richard Schroder, president of Anova Consulting Group. “Jack brings an impressive analytical background and a strong work ethic to our team, which will help Anova continue to deliver top-quality research to our expanding client base.”

Jack will report directly to Andrew Cloutier, Partner at Anova.

ABOUT ANOVA CONSULTING GROUP, LLC

Established in 2005, Anova Consulting Group is a leading market research and consulting firm focused on Win / Loss research and client retention analysis. By helping its clients understand why they win, lose, and retain business, Anova provides strategic perspectives driving better decision making, product development, sales effectiveness, client service, and continuous improvement. Richard Schroder, Founder and President of Anova, is author of a book titled From a Good Sales Call to a Great Sales Call (McGraw-Hill), which details how learning from post-sale debriefing helps close more future sales.

We live in a world consumed by data and analytics. Technology has allowed us to track and measure just about every activity in our lives, both personal and professional. We have the opportunity to gather data and use it to understand our decisions, efforts, and subsequent outcomes. But does it always have to come down to a cold, hard number? What about the experience behind the numbers?

We live in a world consumed by data and analytics. Technology has allowed us to track and measure just about every activity in our lives, both personal and professional. We have the opportunity to gather data and use it to understand our decisions, efforts, and subsequent outcomes. But does it always have to come down to a cold, hard number? What about the experience behind the numbers?

Enter the art of conversation. Through one-on-one interviewing, research opens up and goes beyond the numbers and metrics. In-depth interviewing allows the experience to truly be heard… it tells the story behind the metrics.

Anova’s service offering aims to capture the entire experience – the metrics (hard data and analytics) as well as the open-ended commentary shared by the interviewee. Whether it be a Win Loss Analysis, Post-Implementation, Client Satisfaction, or Departed Client scenario, the interview is designed to go into the specifics and reveal the details that metrics may not be able to capture. These aspects include preferences, attitudes, tone, biases, and competitive comparisons. Simply put, the conversation says what numbers cannot.

The art of conversation is at its best when an interviewer is able to probe effectively. For example, although the interviewer begins every discussion armed with a customized questionnaire template, what often takes place is not a simple Q&A, but rather a deeper, richer conversation. Anova interviewers are trained to transform what may be initially a nondescript answer into a more detailed response by asking questions and probing such as:

The effectiveness of these probing questions are amplified when they are asked by an objective third-party. While a prospect or client may be hesitant to share details about their experience to someone with whom they have a relationship, often times they are more at ease revealing the unfeigned truth to a party understanding of their situation, yet not emotionally involved.

The customer’s voice plays an integral part in understanding and learning about the whole experience. That is why Anova’s reports not only present data and trends, but also support every finding with the interviewee’s verbatim responses during their conversation with our team.

Pure data offers one way to evaluate a single event, but when married to the art of the conversation, the research becomes more complete, and most importantly, more meaningful.

The truth hurts. However, most people would agree that in order to get better at something, you must fully understand where and what you need to improve on… otherwise known as the brutal facts.

The truth hurts. However, most people would agree that in order to get better at something, you must fully understand where and what you need to improve on… otherwise known as the brutal facts.

It’s not just anecdotally. In his National bestselling management book Good to Great, Jim Collins dedicates an entire chapter to “confronting the brutal facts”. Collins substantiates that in order for companies to become great, they must be willing to learn the truth about what they are doing well, and more importantly, what they could be doing better. In fact, it is only after companies do this that they are able to hit an inflection point and begin the breakthrough process towards greatness.

Collins goes on to cite examples of corporations such as Pitney Bowes and Kroger who did not shy away from the brutal facts, but instead embraced hearing the truth about areas they could do better in; no matter how painful it felt initially. In the case of Pitney Bowes, senior executives encouraged their employees to come forward and tell them directly all of the issues clients had complained to them about. They were unafraid of hearing some of the searing commentary because they knew they would be better for it. The leadership team at Kroger made the tough decision to re-strategize their entire business model because they did not shy away from the facts of the grocery store industry changing beneath their feet. The result? Surpassing their competitors and becoming one of the preeminent consumer stores of the late 20th century (the book was published in 2001).

The organizations in Collins’ study that were deemed the most successful were ones who yearned to hear the brutal truth about their efforts while simultaneously having the conviction to know that they would be better for it. Why then, do so many people run from feedback on where they could be doing better?

In Anova’s experience, too often managers are worried the sales team and other members of their organization will resist the feedback if it is not positive. They decide to not collect data on how their company could improve because they are worried employees will view it strictly as an evaluation mechanism designed to judge their performance instead of a process to help them improve it.

On the flip side are companies that understand feedback does help. These companies seek the unbiased, unfiltered, “voice of the client” commentary on why their organization is winning and losing. These companies take the data collected, reflect on the findings, and implement real changes to try and fix potential issues. In 2015, 60% of Anova’s Win Loss Analysis clients saw a decrease in the frequency of mentions of their #1 area for improvement from the year before. These are organizations who have realized that in order to become more competitive, they must first hear what they could be doing better. These companies have accepted feedback as a major driver in organizational improvement. In the eyes of Jim Collins, these are great companies.

SalesForce knows a thing or two about selling B2B. So when Marc Benioff, CEO of SalesForce, talks about the challenges facing enterprise sales, we tend to listen. Here’s what Benioff said in the latest annual report for SFDC about the headwinds facing his own company:

“As more of our sales efforts are targeted at larger enterprise customers, our sales cycle may become more time-consuming and expensive, we may encounter pricing pressure and implementation and customization challenges, and we may have to delay revenue recognition for some complex transactions, all of which could harm our business and operating results.”

These challenges are familiar to any company selling to other businesses. As markets evolve and selling becomes increasingly challenging, sales leaders are searching for an added advantage to give their business the edge it needs. With that in mind, here is how a Win Loss Analysis program can help combat the challenges laid out above:

Longer Sales Cycles Requiring More Investment: Heads of sales are committing more dollars and more human capital towards growing sales. There is no better way to protect an investment in a sales force than by arming them with the intelligence they need to elevate their game. The feedback into what works, what doesn’t work, and what sales strategies other vendors are bringing to the marketplace is invaluable for any sales representative in today’s landscape. Anova estimates that less than 20% of U.S.-based companies utilize Win Loss Research as a feedback mechanism, making the knowledge gained through a formal program a notable competitive advantage.

Pricing Pressure on Products / Services: Whether it is a new or an established product line, prospects will almost always factor in costs to their buying decision. Win Loss Research specializes in extracting pricing information about all competitors and products in the market, and assesses how individual competitors’ value propositions are perceived by customers.

Product / Implementation Questions: Are the product features effective? Is the interface user friendly? Is the implementation process effective enough to get clients up and running in the timeframe they need? Are our clients having buyer’s remorse? These are all questions that impact client satisfaction and retention, and ultimately keep executives up at night. The open-ended Voice of the Client feedback captured in Win Loss studies has proven invaluable to business leaders as they launch new product lines or are checking in on existing services.

A Win Loss study isn’t a magic antidote to sales issues, but can be an effective tool in helping business leaders understand how their prospects perceive their company. In a recent study, Gartner estimated that a comprehensive program can increase win rates up to 50%! Given today’s challenging sales environment, the question shouldn’t be Why Win Loss Research? It should be How soon can we begin?

For Immediate Release

Contact:

Andrew Cloutier

Anova Consulting Group, LLC

(617) 731-1045

andrew@theanovagroup.com

BROOKLINE, MASS., March 17, 2016 – Today, Anova Consulting Group announced the addition of two new Executive Interviewers to its healthcare Win / Loss analysis practice: Lisa Hession-Kunz, Executive Interviewer; and Ellen Murachver, Executive Interviewer.

“In the last year, Anova increased the number of Win / Loss interviews we completed for our clients by 35%. A significant part of this growth happened in our healthcare practice, making it a priority to build out our Win / Loss research team.” said Richard Schroder, Founder and President of Anova.

Lisa joins Anova’s Executive Interviewer team with over 20 years or experience gathering insights to help businesses innovate and improve their processes, products, and services. Her experience ranges from market research and sales enablement to product launches and marketing communications across a variety of businesses and industries. Previously, Lisa was a Product Marketing Manager in the healthcare industry, most recently with Wolters Kluwer and Hologic. Lisa has also managed a variety of marketing, research, and analysis projects with a focus on determining needs and recommending solutions.

Ellen brings over 25 years of experience in medical and social research to her role as Executive Interviewer for Anova’s healthcare clients. Ellen’s career in research began as a consultant to Cornell University’s Department of Human Ecology and the Harvard School of Public Health. She later joined the staff of the Judge Baker Children’s Center, an affiliate of Harvard Medical School and a leader in children’s mental health services and research. Prior to joining the Anova team, Ellen worked at Partners HealthCare, where she used her extensive knowledge of clinical trial operations and human subject research as project manager of numerous trials investigating the innovative use of technology in healthcare delivery.

Established in 2005, Anova Consulting Group is a leading market research and consulting firm focused on Win / Loss research and client satisfaction analysis. By helping its clients understand why they win, lose, and retain business, Anova provides strategic perspectives driving better decision making, product development, sales effectiveness, client service, and continuous improvement. Richard Schroder, Founder and President of Anova, is author of the Win Loss Analysis book titled From a Good Sales Call to a Great Sales Call (McGraw-Hill), which details how learning from Win / Loss analysis interviews helps close more future sales.

You must have prior success selling conceptual services to senior management of mid-to-large size companies in an emerging market. You excel at finding and closing new business and have excellent listening and questioning (consultative selling) skills. You have a strong sense of personal urgency, are goal-oriented, a high achiever, and work well in a team-selling environment. Experience with enterprise technology or software solution selling, healthcare, financial services, human resources / benefits, sales enablement, or consulting helpful, but not required. You must be willing to travel to 25% and have prior earnings of at least $150,000 required.